Idenfo Direct – Seamless Identity Verification in Pakistan

Trusted, Secure, and Compliant Digital Onboarding

Idenfo Direct’s advanced, fully compliant KYC solutions can help you onboard customers quickly and securely.

ANTI-MONEY LAUNDERING TRAINING COURSE

Anti-Money Laundering and Compliance Procedures and Requirements

Idenfo Direct won Best Regtech Solution Award at the MENA Fintech Association Awards 2024

Raise The Bar On Your Recruitment Process!

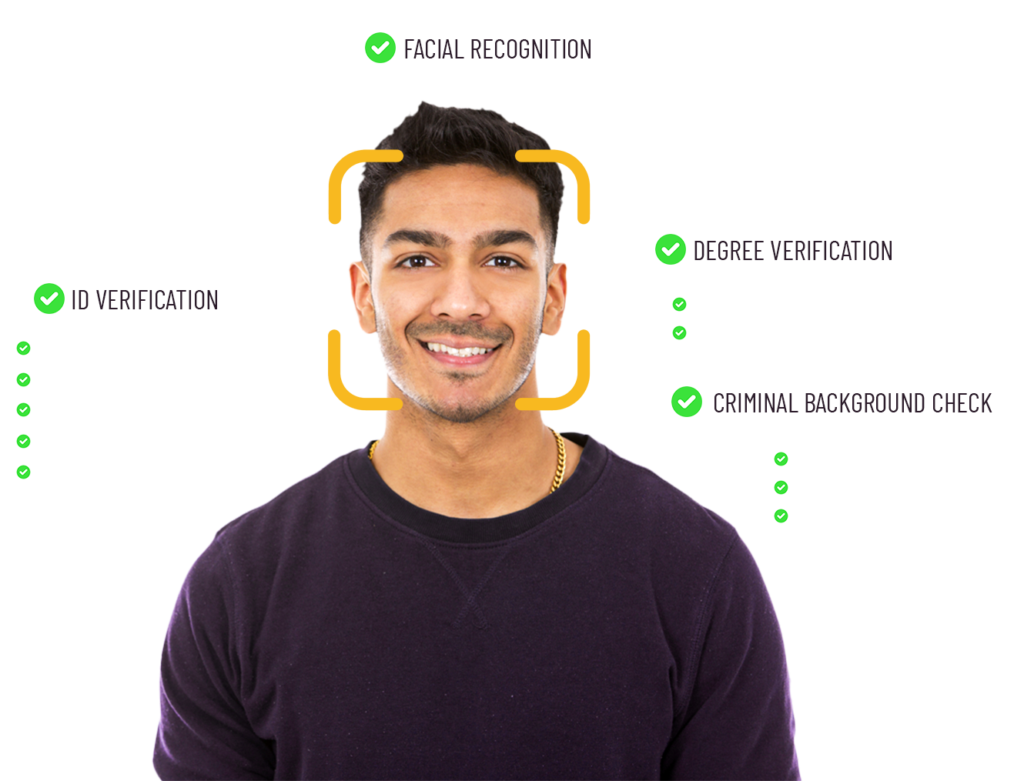

Digital Identity Verification

Verify your customers’ identities effortlessly with IDenfo Direct’s advanced eKYC, digital identity verification, and AML solutions tailored for Pakistan. Seamlessly integrate our technology into your onboarding process, safeguard against fraud, and accelerate your conversion rates. We offer:

- CNIC Authenticity – Ensure ID documents are valid and match official records

- Face Verification & Liveness Checks – Prevent fraud through AI-powered facial recognition

- Sanctions & PEP Screening – Screen individuals against SECP, SBP, and global watchlists

- OCR & Data Extraction – Auto-capture details from CNIC to streamline onboarding

Fully Compliant with Pakistan’s AML & KYC Regulations

Pakistan’s financial and digital service providers must comply with stringent regulations set by:

- State Bank of Pakistan (SBP) AML/KYC Guidelines

- Securities & Exchange Commission of Pakistan (SECP) Compliance Framework

- FATF Recommendations for AML & CFT

- NADRA e-KYC & Digital ID Integration

Idenfo Direct helps businesses meet these compliance requirements effortlessly, reducing onboarding times while ensuring regulatory adherence.

Industries We Serve in Pakistan

Banks & Fintechs

Enable seamless e-KYC and remote account opening

Insurance & Microfinance

Verify policyholders instantly

E-commerce & Digital Platforms

Prevent fraudulent sign-ups

Real Estate & Investments

Ensure investor due diligence

Telecom & Ride-Hailing

Securely onboard users with verified identities

Get seamless identity verification your way!

Choose our all-in-one platform for instant access to powerful features, or integrate our SDK to bring custom identity solutions directly into your app.

Whatever your use case, we make secure verification fast, flexible, and scalable.

Why Choose Idenfo Direct?

Fast & Automated Onboarding

Reduce verification time from days to minutes

AI-Driven Fraud Prevention

Detect identity fraud with advanced liveness and deepfake detection

Regulatory Compliance

Built for Pakistan’s AML/KYC framework

Global Expertise, Local Focus

Proven ID verification solutions tailored for Pakistan’s market

Platform

Goodbye to manual processes and say hello to efficient online identity verification

Idenfo Direct offers robust employee verification services.

Digital onboarding journey to automate your business and create frictionless onboarding for employees

Keep sensitive information safe and accessible with our automated profile change alerts & audit trails

Reduce identity fraud with our path-breaking technology and ensure you’re hiring someone reliable

Name-screening against applicable national and international sanctions and fraud databases

Save on unnecessary fines and fees thanks to our regulation & compliance expertise

Automatically identify high risk candidates for enhanced due diligence

Features

- API integration

- UAE Pass Authentication

- Self Service and Excel Onboarding

- Deeplink Onboarding with Digital Signature

- Name Screening (Sanction, PEP, Special Interest, Adverse Media)

- Individual Risk Assessment and Business Risk Assessment

- KYC and KYB (UBO, Shareholders, Directors, etc.)

- EDD (Enhanced Due Diligence)

- Email Notification on Document Expiry

- Liveness Detection Check

- User Invite/User Role

- Activity Log

- Document Storage

- STR Records

- Data Updated Every 24 Hours

- Download Report (Excel & PDF)

- Online & Onsite Support

- Software Training Video & Manuals

- Global Coverage

- OCR and Document Verification

- Graphical Representation & Customer Statistics

- Periodic Check & Ongoing Monitoring

- Linking Individual/Shareholder and Company

- Adverse Media Exact Name Match

- Adverse Media Rescreening

Subscription plans that are made for you,

and grow with you!

Find out more about our packages

Frequently Asked Questions

WHAT IS IDENFO DIRECT?

Idenfo Direct is an affordable, subscription-based digital identity verification service. It includes fraud detection and financial crime checks such as risk rating, adverse media, and periodic reviews for various businesses.

HOW DO I SIGN UP?

You can sign up by simply entering your name, email address, and country.

CAN I VERIFY DOCUMENTS FOR ANY COUNTRY?

Yes, automatic verification checks (including facial comparison with ID cards) can be performed for any country, as long as the ID photo is clear and undamaged.

WHAT CAUSES A PROFILE TO BE TERMED 'HIGH RISK'?

While the exact algorithm is not disclosed, typical red flags include:

- Name matches on recognized sanction lists

- Non-residency in the country of application

- Nationality from a country subject to UN sanctions

IS IDENFO DIRECT GDPR COMPLIANT?

Yes, Idenfo Direct is fully compliant with GDPR regulations to ensure data privacy and security.

IS MY DATA GOING TO BE SHARED OR USED BY ANYONE ELSE?

No, Idenfo Direct does not share customer data with third-party services. Your data is treated with the utmost confidentiality and security.

IS LIVENESS DETECTION AVAILABLE AS A FEATURE?

Yes! The onboarding journey includes a video section with instructions to ensure the video is recorded live.

DO YOU CHECK SANCTIONS?

Yes, we check a wide range of sanction lists, including UN, OFAC, EU, HMT, and other regional lists.

HOW LONG DOES THE VERIFICATION PROCESS LAST?

It typically takes 2-3 minutes to input details and record a liveness check video.

WHAT IF I WANT TO CHANGE THE VERIFICATION DECISION?

A workflow exists within the system to review and, if necessary, overturn the verification result.

HOW IS THE RISK SCORING DONE?

The exact algorithm isn’t disclosed, but risk scoring considers attributes such as nationality, country of residence, work type, and other factors.

DOES IDENFO DIRECT ENSURE EFFECTIVE DATA PRIVACY?

Yes, Idenfo Direct prioritizes and implements robust data privacy measures to safeguard your information.

Get Started with IDENFO

Upgrade your identity verification and AML compliance with Idenfo Direct. Book a demo now to see how we can streamline your onboarding and fraud prevention processes.