Apply now for fast pre-approval

Give us a call and let's have a chat.

Mortgage Brokers Glen Waverley

Making loans simple - our services are 100% free.

At Mortgage Brokers Glen Waverley, we pride ourselves on being market leaders when it comes to providing our clients with the best financial solutions. We understand that a lack of knowledge and information around financial decisions can be damaging, so we are committed to guiding and educating our clients throughout the entire process and handling all aspects of their application. So whether you're looking to invest, consolidate debt or buy your first home, we can find the right solution.

We don't charge fees. The lender you select pays a commission to us. Regardless of the lender, our commission rate is the same. We will give you the lowest rates and the most significant benefits.

In Melbourne, it is important to consider obtaining the best mortgage rates when making one of the most significant financial decisions – buying a home. It is discussing with an expert mortgage broker specialist who can give a complete overview and explanation of the process.

Are you..

Your Glen Waverley mortgage broker

We offer competitive rates and expert advice while handling the entire loan process.

It is essential to research the financial services that might benefit an individual most significantly instead of relying solely on the bank with which an individual has been most familiar. Therefore, we aim to understand an individual’s financial situation and offer a customised solution.

We strive to save you money on home or investment loans, offering the best and most competitive loan options. In addition, we provide support throughout the process.

Why Use A Mortgage Broker?

We take care of all the work for you. Our experts will guide you to the best options available, which are free of charge. In addition, we have the processes in place to find a competitive mortgage that perfectly matches your needs.

The mortgage market is large and ever-changing, and searching for the right loan product is confusing. As your Mortgage Broker, our job is to understand your financial goals and use this understanding to assess your financial health and long-term goals. Then, we will use this data to identify the most suitable option that gives you the utmost value and serve your strategy. Our service is a comprehensive approach, from gaining approval from the bank to handing over your loan without requiring effort.

We eliminate the guesswork involved in choosing a lender and loan, often having access to special rates. Additionally, all parts of the loan are transparent and easy to understand for our clients; we're willing to explain any further details.

Your personalised Mortgage Broker service in Glen Waverley.

Let us do all the work for you.

We, at Mortgage Brokers Glen Waverley, love to help first time home buyers secure their first property purchase. We understand how it feels to be nervous and not have much information on-hand. We’ll be explaining to you how ‘First Home Owner Grant’ works, and be it can benefit you.

Our goal is to make the entire process easier, as we work with you and provide you guidance, every step of the way. See how we can be of service to you by giving us a call and speaking to our consultants.

First Home Buyers

Let us take care of the details.

Mortgage Brokers Glen Waverley specialises in assisting first-home buyers with their property purchases. We understand the process of buying a home can be daunting and are here to help with any questions about the 'First Home Owner Grant' and how it can benefit you.

We are here to make the process easier for you, providing guidance and support. Contact us now to discuss your needs and find out how we can help.

Buying your first ever home?

We'll show you how you can purchase your very first home with as little as a 5% deposit.

Why Us?

With our premium service, you will have access to all loan options so that you may make the right financial decision. Additionally, we’ll keep you up-to-date with any strategies relevant to the current environment. If a better solution is available within the next 12 to 24 months, we will inform you and present you with the best ways to take advantage of any new opportunity as the market changes.

We strive to provide open and authentic experiences for our customers. We will assist you in finding a loan suited to your family’s needs and grant you a personalised experience by understanding and working with you individually.

We provide 24/7 access to our services, so you can cater for any questions or needs you have promptly. We also emphasise establishing a solid relationship with our clients that extends past a mere transaction.

Always on Time

We'll get your application processed super quickly.

Hard Working

We're entirely committed to our clients.

24/7 Availability

We're always here to help.

You no longer have to wonder which is the best mortgage broker in your vicinity.

We are a reliable and trustworthy financial service provider knowledgeable about home loans and related services. We offer an all-in-one platform that simplifies the process for our clients and ensures their long-term success. Our team of experts will work with you directly to secure your financial needs are met without hassle.

It is possible to benefit from this situation.

We offer a full range of financial services

Refinance your home loan

Looking to refinance your home loan? Well look no further. We know the process back to front, and understand that for many people – the prospect of refinancing doesn’t sound too compelling at times, considering the effort required.

No need to worry, because with Mortgage Brokers Glen Waverley, we’ve got the expertise, technology and the channels to be able to process your refinancing applications with absolute ease and efficiency.

Before even making a start, we conduct a preliminary assessment to make sure that you’re better off than what you’re currently receiving with respect to your current loan package. This is to make sure that you will benefit.

Reasons to REFINANCE

The process we undertake in refinancing your home loan is quite simple. We use a highly efficient online system that has a direct channel with the vendors. This means your application is received in no time and can quickly be processed!

It’s best to always check first that you’re able to receive a better deal. We not only make sure that you’re receiving a more competitive interest rate, but also checking that your bank’s serviceability is either the same or better. What this means is that we want to make sure you are future-proofed so that if you want to scale your property portfolio, you’ll be able to access further funds, rather than solely finding a better interest rate.

Refinancing your loan can also provide an opportunity to access additional cash flow by enabling you to utilise any existing built up equity from your property portfolio. If you’re looking to commence a renovation or construction project, this is a cost-effective solution to increase your cash flow.

It’s worth considering to consolidate your existing debt, by ensuring that things are kept simple. This is done by keeping your debt in one place so that it’s much easier to keep an eye on.

Some examples would be to combine any existing credit card or personal debt, with your mortgage as there are some financial benefits in doing so.

Give us a call today.

Let’s have a chat to see how we can help you best.

Our End to End

Process

1. Call us or fill in the quote form

We'd like to understand your financial situation better to provide you with the best service. Therefore, we'll ask many questions and help you devise a strategy towards achieving your financial goal. Furthermore, we'll tailor our advice to your unique needs since we recognise that everyone has different circumstances. Additionally, we're dedicated to helping clients learn about how the process functions and the current market. To this end, we'll explain loan products and how interest rates operate and explore the differences between an 'interest only' loan versus a 'principal and interest loan.' Ultimately, we strongly feel that this knowledge is helpful in life.

2. The process of arranging a pre-approved loan

Once we understand your financial situation, goals and what you want to do, we will outline and develop a strategy that fits your needs. A pre-approved loan is a great way to provide peace of mind when buying an investment property, like a new home. It will show you how much you can spend and act fast on any property that interests you. In addition, the pre-approval process is quick, so you can search without wasting time. We will provide an A-Z breakdown of the elements involved, such as interest rates, monthly repayment costs and other options. We will also explain the differences between 'variable' and 'fixed' interest rates, as well as the different types of deals available compared to a loan offer. Depending on your goal, we can discuss the advantages and disadvantages of collaborating with big or small banks regarding their lending capabilities in the long run. People commonly make mistakes by looking only for low-interest rate banks without considering their ability to lend more in the future. It is essential to look at all possibilities for the long term.

3. We will assist in approving and processing your loan, allowing you to relax during this process.

After submitting the required documentation, we will obtain your loan approval, contact the bank, and update you on the progress. The process typically takes 1-2 weeks to complete. At Mortgage Brokers Glen Waverley, we don't just care about you until your loan settles. We remain available to answer any questions throughout the loan's lifetime. Moreover, our team reviews your loan annually and ensures you get the best package available. Finally, through comparisons with other lenders, we can help you get a lower rate with your current lender or help you consider refinancing with another institution if it will benefit you.

Home loans

At Mortgage Brokers Glen Waverley, we understand the complexities of the home loan process. We have the extensive industry knowledge and can offer guidance to help find the best home loan package. Property purchasing involves more than determining a desirable location; there is finance and paperwork to consider, and it can be time-intensive.

If it is your first time, you may feel uneasy about finding the right home loan in Point Cook. We take a holistic approach to understanding your financial health and goals first, which helps us compose the most suitable package for you. Then, pre-approval will grant you the power to begin contract negotiations on the desired property. On top of that, we handle the whole loan application procedure and update you from start to finish.

If you are a first home buyer, we can assist with the application for the First Home Owner Grant and guide qualification criteria.

Investment loans

If you are seeking an Investment Property Loan, we know the best offers currently available and can identify the most suitable loan package for you. We can discuss the proper loan structure, such as whether it is interest-based or a combination of principal and interest. Additionally, we can craft strategies to minimise lenders’ mortgage insurance costs while meeting your investment aims and expectations of return.

We can assist you in reviewing your entire property portfolio to ensure you get the best deals. We will coordinate with the banks on your behalf and work to identify the loan products that offer the best value from a range of lenders. Additionally, we can keep track of deadlines, such as property valuations and settlement dates.

All of our services are without any cost to you.

Renovation loans

Home renovations can be costly, particularly for properties that need a lot of structural repairs. However, there are various ways to cover these expenses, and it is essential to consider all options carefully to balance your financial commitments.

Financing your new property purchase can be achieved by paying out of your pocket using savings or utilising equity if you have accrued it from a previous property.

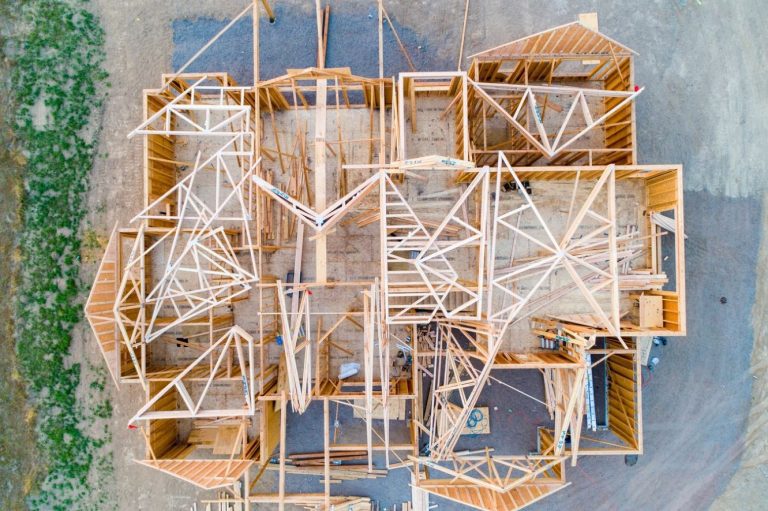

Construction loans

Securing financing for home construction can be complicated, but a construction loan can cover the costs associated with building and construction. However, it is essential to note that acquiring such a loan may not be easy.

A construction loan can provide flexibility and special conditions. This kind of loan enables you to make payments according to the individual stages of your project, drawing down either instalments or chunks (known as ‘progressive draws downs’). It is beneficial, as it allows you only to pay interest on the amounts drawn from the loan facility. In addition, the loan amount is calculated in advance by financial institutions.

Commercial loans

Commercial financing is available from multiple sources, including financial institutions. Our Finance Brokers at Glen Waverley can assist in finding the best solution for your investment plans, whether you need short-term or long-term capital funding. This way, you can get the most value for money when it comes to debt financing for your next business venture or project.

Car loans

Securing a car loan can be challenging, so we are here to support you at Mortgage Brokers Glen Waverley. We will look for the best value loan so that you aren’t overwhelmed by the cost upfront. This method also helps you to manage your monthly expenses and make sound financial plans.

We’ll research possible lenders and loan packages to create a strategy that will meet your requirements and enable you to purchase the car you desire.

Not located in the Glen Waverley? No worries - we can serve anyone nationally with ease.

We service all areas of Glen Waverley.

Ashwood

Blackburn

Blackburn North

Blackburn South

Brandon Park

Burwood East

Chadstone

Forest Hill

Holmesglen

Mount Waverley

Mulgrave

Notting Hill

Nunawading

Oakleigh

Sandown

Springvale

Vermont

Vermont South

Wantirna South

Waverley Gardens

Wheelers Hill

Approved Glen Waverley Mortgage Brokerage Service

Our Mortgage Broker, Glen Waverley, can assist you in finding the best loan product. We strive to provide a comprehensive solution and are committed to guiding you throughout the process. Our client’s satisfaction is our priority, so we work hard to deliver a high-level service tailored to their needs. We draw on years of experience to craft the optimal financial strategy for each client. Then, from start to finish, we partner with them to create the right lending plan according to their specifications.

Once your loan is accepted, our journey does not stop. We will contact you and check the process with quick reviews. Additionally, if necessary, we will strategise again. Given our access to the best market deals, it is beneficial to talk to a licensed professional – this offers fantastic deals and helps one fill out paperwork quickly and seamlessly. Overall, this provides excellent benefits for our clients.

We take care of all the necessary processes to provide a stress-free experience while allowing you to focus on other tasks.

Call today.

We understand the challenges and pressures when it comes to financial decisions. That is why we prioritise providing you with total peace of mind by offering personalised services and ensuring you get the best value for your money. So allow our Mortgage Broker, Glen Waverley, to care for you.

Our goal is to offer exceptional customer service to our clients. We strive to achieve the highest quality of work and equip our clients with new knowledge. We will listen carefully to your needs and ensure a comprehensive and transparent service for all developments.